Welcome back to MondayMunday, my blog on all things fintech and crypto. Today we have The Intersection, where I chat with fintech/blockchain founders to uncover what they are working on and why they are essential to bridging crypto and the real world.

Intersection /ˌin(t)ərˈsekSH(ə)n/ noun. Where finance and blockchains meet to create endless new possibilities and products to better serve financial systems.

Today we are speaking to Mark Titmarsh who leads Digital Assets at Malca-Amit. He has over a decade of experience in the insurance industry building products for Aviva. In his new role, he is taking Malca-Amit’s 50 years of experience with vaulting infrastructure.

Watch our chat above to understand Mark’s views on:

What role a vaulting company plays in the digital asset space

Understand what is underpinning the rise in custody solutions

The role Malca-Amit play in this

Views on the future of asset custody and tokenization of physical goods

To the post below 👇

What does Malca-Amit do?

Malca-Amit is a vaulting company, that provides the physical infrastructure for the transportation and secure storage of high-value goods. This is in the form of multiple global vaults and robust armoured transportation to secure physical goods.

The need for vaulting infrastructure with physical assets such as gold and fine art is well-known due to the difficulty in storing them safely and securely. However, the need for physical infrastructure is often overlooked when you are building digital assets solutions.

In digital assets, we often assume that all security is handled online, with advanced cryptography creating immutable and auditable transactions for assets. However, for ownership on the blockchain, you are reliant on becoming your own bank and holding private keys to your wallet address.

Given this, many people rely on custodians to store their digital assets on their behalf or leverage their technology to better secure their private keys. These custodians often promote technologies that prevent key misuse use and sharing when signing transactions but their infrastructure also needs to be held securely to prevent loss or theft of keys, this is where Malca-Amit step in providing the physical vaulting and transport infrastructure for the safe guarding of keys.

This rise of custody providers

As discussed in my blog on custody providers, we have seen the rise of custody players in the market as a foundational element of providing crypto services to users. Whilst here we made the distinction between:

Technology providers - Those who provide services to store keys and share keys to protect them using technologies such as MPC and HSMs.

Direct custodians - Those who hold your crypto assets securely, leveraging technology to secure them.

These providers leverage technology to secure your keys. However, this technology relies on physical hardware that needs to be stored in a secure location to provide additional security for customers and regulators alike.

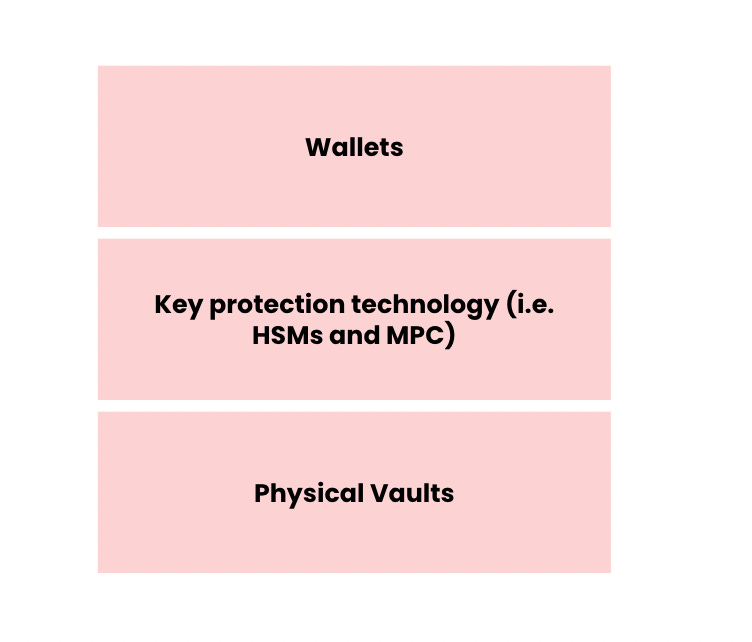

In reality, the stack is comprised of the technology layers we see such as wallets and custodian technology but also of vaulting to store physical hardware.

Malca-Amits role?

Malca-Amit plays the role of using its vaulting and transportation services for distributing keys and securely generating keys. This is in the form of two services:

hardware security and storage - They allow custodians to hold their infrastructure in secure vaults distributed across the globe. This provides greater security as custodian technology provides assurance they cannot see the private key, whilst Malca-Amit’s vaulting infrastructure provides security for the hardware make sure it is tamper resistant.

Secure key generation and recovery - Another part of their toolkit is secure key generation and recovery. Whilst many providers simply provide the vaulting infrastructure, Malca-Amit allow you to securely generate these keys and distribute them using their infrastructure. This allows custodians to be sure that generated keys have not been tampered with en route to their secure locations.

This allows Malca-Amit to provide a full-stack service for key generation and hardware security using their proprietary infrastructure to custodians. This provides benefits to the customer as if a key gets compromised you are reliant on one provider for transport and key recovery in case of an emergency instead of a fragmented supply chain.

Mark’s background - Insurance for custody

Mark spent 10 years at Aviva building digital insurance products before delving into the world of crypto. This insurance background has given Malca-Amit a compelling value proposition, as Mark states “less than 2% of crypto wallets are insured” so Malca-Amit has created a fully insured storage service for the cold storage of cryptocurrencies and NFTs. They offer their customers full liability protection for the assets secured on non-custodial wallets in their care. This unique blend of combining traditional market infrastructure (In this case, insurance) with digital assets provides a better consumer experience when interacting with new technology.

Thoughts on FTX: self-custody vs 3rd party custody

The recent FTX collapse has highlighted the need for robust safety around 3rd party custody. However, for the adoption of crypto, these solutions are still required as decentralisation exists on a spectrum. Even though some may feel comfortable with self-custody of assets, for many institutions secure custody will be needed for them to adopt this technology as ‘being your own bank’ has security and risk associated with it. Given this, robust legislation such as MiCA which has provisions around asset custody and future regulatory burden on centralised solutions will accelerate industry adoption of digital assets, which can only be a good thing.

A view to the future

One of the most exciting things happening from Mark’s perspective is the tokenization of real-world assets. Given Malca-Amit’s place in securing physical assets as well as digital ones, the ability to tokenize these assets and trade them using modern infrastructure whilst being able to verify the authenticity of the asset represents a novel approach to how asset-backed tokens and NFTs could shape the future of our industry.

To learn more about Mark’s perspective on the industry watch the interview and feel free to reach out to him on LinkedIn.

If you want to learn more about what Mark is doing at Malca-Amit visit their website.

If you are a fintech builder or investor feel free to reach me by replying to this email or DM on Twitter or LinkedIn, I’d love to chat! 🙏