Before we start, it’s a sad state of the world seeing the recent SVB failure and impact on the start-up and crypto markets. I hope all the founders and builders out there impacted battle through these events and governments support the protection of depositors. It’s a stark reminder there is still work to be done in improving the stability of markets and that isn’t just an issue that solely faces trad-fi / crypto / fintech but all of them combined. After the dust settles, let's continue building a robust future for financial services, but for now, be kind…

Welcome back to MondayMunday, my blog on all things fintech and crypto. Today we have The Intersection, where I chat with fintech/blockchain experts to uncover what they are working on and why they are essential to bridging crypto and the real world.

Intersection /ˌin(t)ərˈsekSH(ə)n/ noun. Where finance and blockchains meet to create endless new possibilities and products to better serve financial systems.

Today I am excited to welcome Pet Berisha, the founder of Sporting Crypto, who was kind enough to give me his time to talk all things sports brands entering Web3. Whilst a different track to the traditional FS focus of our talks, how brands enter decentralised technology provides an important overview of how any company (even financial services) can approach user education and adoption of this technology.

If you enjoy these posts please feel free to subscribe and also follow Pet’s Sporting Crypto Blog

How did Pet get into Blockchain?

Pet first started his career at 11:FS, the boutique fintech consultancy where by happenstance he ended up working on the fabulous Blockchain Insider Podcast (Shoutout to Mauricio)! This is where his interest in blockchain started from a deep learning experience in the space through the countless topics and guests he was exposed to. From this learning, it clicked and made sense for the need for a trustless, open and permissionless way to transact.

Libra as the cover for innovation.

Pet’s time covering the Blockchain Insider was in 2019 and coincided with the rise of Libra, Libra was Facebook’s attempt at bringing a new digital currency into the world and ‘poked the bear’ of regulators globally. This took the attention away from the crypto scene and led to the innovations we see today (e.g. Solana, Uniswap, Polygon) coming out of the woodwork. This fostered the foundation of the innovation we see in the market today and arguably the rise and prominence of blockchain technology for financial and non-financial use cases.

Sy’s Secret Santa and crossing the chasm of culture and communication

Whilst 11:FS is a financial services consultancy business, Pet’s passion didn’t lie within that area. So after a funny present of gifting a Crypto Kitty for Secret Santa to Simon Taylor. It actually started making more sense, as more people interact daily online and digital lives become more intertwined with physical life having native digital ownership is a prerequisite for this change.

Additionally, the technology and implementation of common token standards (e.g. ERC-721 and ERC-1155, which provide common standard unique tokens with the ability to batch transactions to reduce cost on the network) allowed this digital ownership to go across industries and allow NFTs to cross the chasm of ‘financial nerdy stuff’ to become a new layer for culture and communication to form around.

Do users need decentralisation?

Users don’t value decentralisation! It doesn't matter to an end user whether their solution is running on Solana vs Bitcoin, similarly to how you don’t care if a web app you use runs on AWS or GCP.

So where do blockchains add value?

It can be easy then to dismiss the use of blockchain technology, however, it does provide some useful characteristics on the backend to improve the user experience. These services are:

Ownership

With blockchain technology, you can provide direct digital ownership of assets natively online. This opposed traditional centralised systems where they are in control of your assets e.g. Facebook owns the picture you upload there.Portability

Native digital ownership also powers portability, now you own assets on the blockchain (This could be an NFT, token or social data). You can now port this over to an application of choice. The reimagines how services are built, now users are in control of the services that get built around their data and not services like Facebook being built with data and networks you have provided.

Once this gets beyond cultural artefacts and NFTs, this could change the mindset of how people interact online, we have a long way to go in this regard, but just showcases the power of the technology we have at hand.

Blockchains technological value

Above we discussed how blockchains provide a benefit in terms of ownership and portability. However, many still argue they are a technology in search of a problem.

However, Pet breaks this down in the stablecoin example, if we look at stablecoins, cross-border payments via this technology are faster and cheaper than a cross-border ACH.

Furthermore, if we look at the transparency of this in global markets, you currently have no way of seeing the total value of the dollar in circulation. Stablecoins and blockchain provide this instantly using decentralised ledgers improving the visibility of finance.

sometimes people overcomplicate the value added by this technology, when it's relatively simple. For all of Blockchain’s flaws, we currently have no better way to trustless verify and track assets which are super powerful for markets and innovation.

Finding the niche of sports x crypto

Pet has been an avid sports (and Arsenal fan) and interested in media from his 11:FS days. His first interaction with the world of sports was running the Fintech League at 11:FS. Following this, he did two DAO-funded media x web3 projects. This intersection culminated nicely when he was approached to lead Copa90’s Cryptomedia to figure out its place where sports, media and web3 collided.

In this role, he was having multiple calls with teams, brands, players etc to figure out this space but ultimately all this noise led to the need to develop a thesis around certain aspects of Web3 for sports.

This culminated, in launching his blog (sportingcrypto.substack.com) to tack the key issues in space starting with the explosion that was Sorare’s whopping $680m funding round and garnered multiple initial fans and substantial growth in the space.

Advice for Brands entering web3

The first place to start is by simply learning and educating people about the technology. The best sports organisations are the ones that don’t start with a goal but start with an exploration of the technology and how the benefits can align. The act of doing this allows you to be open-minded and find the right use for the technology, he notes “some of the best brands and sports teams realised they may not even need to technology for another three years”.

Examples of successful projects

Whilst Pet touched on many examples of great projects, I am going to touch on two which hopefully showcase why and how web3 can provide better experiences for users.

Reddit

Reddits value proposition was simple, allow you to own custom Reddit avatars you could use on the platform or store and trade as digital art. They captured the market by providing a use-case which matched the technology and made it accessible with card payments, low-price and spinning up native wallets for you.

Nike .SWOOSH

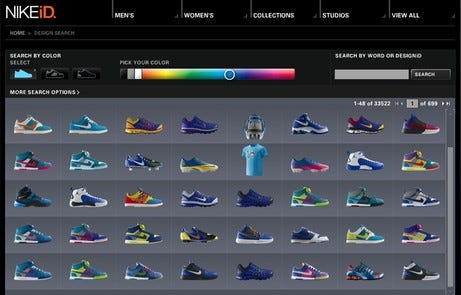

Nike .SWOOSH was born out of an acquisition of RTFKT. This experience of buying digital customisable sneaker art can be compared to what we saw physically when Nike had their Nike ID platform.

NikeID was Nike’s customisable sneaker-buying platform provides a great comparison to show how web3 augments traditional business. Back when Nike ID, many kids played around with making custom looks, yet this business was expensive for target users (kids) who couldn’t afford inflated prices for custom sneakers. Furthermore, this business was inherently limited due to scaling custom physical assets.

If we look at .SWOOSH, it uses blockchain to scale the customisation and ownership with digital assets. The technology allows you to effectively aggregate customer benefits in a scalable fashion using digital ownership.

Acquisition vs Build?

As we have seen with Nike, the RTFKT acquisition has proved a shrewd move for their business. However, Pet argues this success is the exception rather than the norm.

Whilst most brands want to acquire or hire agencies with expertise to run their Web3 Activities. The best plays are ones from organisations who understand the ‘why?"‘ around using technology and the rise of infrastructure tools to abstract the building of NFTs and smart contracts may negate the need to buy service providers to deliver a robust solution.

If you want to reach Pet you can reach him through Twitter, LinkedIn or follow his great newsletter

If you are a fintech/crypto builder or investor feel free to reach me by replying to this email or DM on Twitter or LinkedIn, I’d love to chat! 🙏